President Paul Kagame of Rwanda at the 2010 Tribeca Film Festival.

(Photo credit: Wikipedia)[/caption]

President Paul Kagame of Rwanda at the 2010 Tribeca Film Festival.

(Photo credit: Wikipedia)[/caption]

By Andrea Redmond & Patricia Crisafulli

Amid the rhetoric, pro and con, around Rwanda, the impartial voice of the marketplace has spoken, with a ringing endorsement of its economic turnaround and prospects for continued growth.

Last week, Rwanda’s debut on the global bond market raised $400 million with an offering that was heavily over-subscribed by nearly eight times. Final yield on the 10-year bonds of 6.875% was less than reported expectations in the low-7% area, due to strong buyer interest. Proceeds will go to repayment of bank loans, infrastructure such as a hydropower project, expansion of the national airline RwandAir, and the completion of a convention center in the capital of Kigali.

The successful bond issue triggered a flurry of enthusiastic postings on Twitter from Rwandan government officials (very savvy users of social media). Finance Minister Claver Gatete hailed a “great day for Rwanda after the investors have shown confidence in our economy….” President Paul Kagame tweeted his congratulations to those who worked to bring the bond offering to a successful conclusion, adding “Let’s continue forward.”

Beyond Rwanda’s enthusiasm, what speaks even more loudly is the oversubscription for these bonds. Yes, there is interest these days in higher yields and geographic diversification. But specific to Rwanda, the success of this offering shows widespread recognition that what has happened to transform this country socially, economically, and politically is real and sustainable.

Rwanda truly is the ultimate turnaround. For the African nation, the comeback has been from the depths of human bankruptcy: genocide in 1994 in which 1 million people were killed in 100 days. Since then, the rebuilding has been impressive, with GDP growth that has risen by 7-8% annually in recent years. In 2012, GDP per capita grew to US$644, up from $593 a year before, according to Rwandan government figures.

Fitch, which affirmed a “B” rating on Rwanda, noted its “solid economic policies and a track record of structural reforms, macroeconomic stability, and low government debt” (23.3% of GDP in Rwanda, compared to the median of 43.5% among B-rated peers). Certainly, the country is not without its challenges; it is landlocked, which vastly increases transportation costs for imported goods, and more electrical generation capacity is needed. It is often clouded by geopolitics, most notably the morass of conflict in the neighboring Democratic Republic of the Congo (DRC). Kagame draws criticism for being too tightly controlling, and human rights watchers charge the country suppresses political opposition and free speech.

Rwanda, post-genocide, remains a complex place. Having the perpetually turbulent DRC as a next-door neighbor (where some masterminds of the genocide have sought refuge) complicates matters. Yet the country, backed by the strength of its leaders, has clearly put itself on a path of revival and renewal based upon values such as one Rwanda for all Rwandans. It offers universal health care and 12 years of compulsory education for all children, has made significant gains in poverty reduction and food security, and seeks to foster private sector development though homegrown entrepreneurship and foreign direct investment.

Rwanda, post-genocide, remains a complex place. Having the perpetually turbulent DRC as a next-door neighbor (where some masterminds of the genocide have sought refuge) complicates matters. Yet the country, backed by the strength of its leaders, has clearly put itself on a path of revival and renewal based upon values such as one Rwanda for all Rwandans. It offers universal health care and 12 years of compulsory education for all children, has made significant gains in poverty reduction and food security, and seeks to foster private sector development though homegrown entrepreneurship and foreign direct investment.

As we wrote in Rwanda, Inc., the country is no Garden of Eden for business investment. The wheels turn slowly at times with extra bureaucracy—the unintended consequence of strictly enforced zero tolerance for corruption, a policy that is a huge positive for business—and there is need for human capital development, particularly at the middle tier. But Rwanda’s progress continues apace, which the marketplace, the impartial arbiter, recognizes.

Andrea Redmond and Patricia Crisafulli are co-authors of “Rwanda, Inc.: How a Devastated Nation Became an Economic Model for the Developing World” (Palgrave-Macmillan, 2012).

]]>

]]>

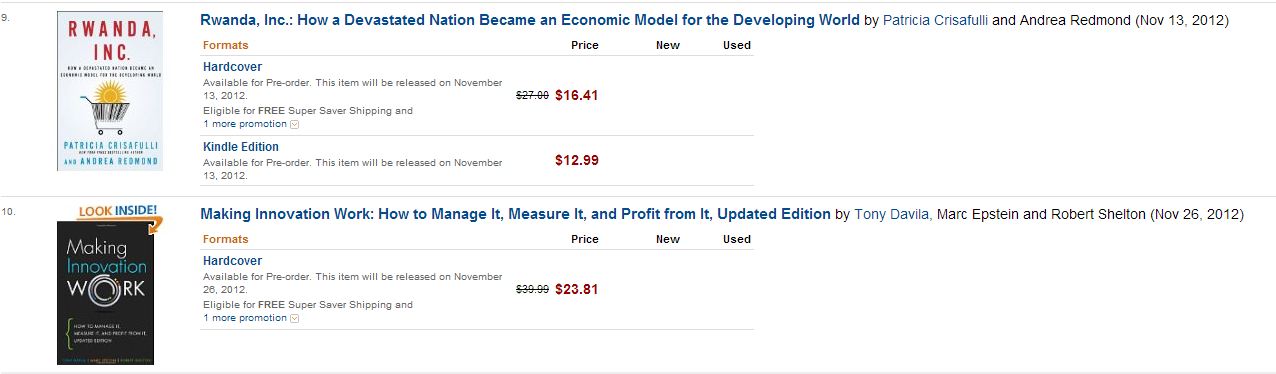

]]>RWANDA, INC. by Patricia Crisafulli and Andrea Redmond hits No. 9 on the Amazon Best Business Book list for November, and will officially be on sale on November 13th.

]]>Rwanda, Inc.: How a Devastated Nation Became an Economic Model for the Developing World

by Patricia Crisafulli and Andrea Redmond

“In Rwanda, Inc., Crisafulli and Redmond recount the rise of an unyielding people and their chief executive, President Paul Kagame. The Rwandans, rallying around their national pride, have built predictable systems that reward enterprise and hard work, and created an exceptional blueprint for other developing countries.”—President Bill Clinton

“Andrea Redmond and Patricia Crisafulli are known for their ability to connect with people, examine leadership skills and teach us through their compelling observations and insights. As advocates for the future of Rwanda, they are now telling a story that we can all benefit from hearing.”–Jamie Dimon, Chairman and CEO, JPMorgan Chase

]]> In their latest, Crisafulli and Redmond (coauthors of Comebacks: Powerful Lessons from Leaders Who Endured Setbacks and Recaptured Success on Their Terms) investigate the Rwandan renaissance, focusing on “Rwanda’s CEO,” Paul Kagame, a former refugee turned politician. Now in his second term as president, Kagame looks toward the future in light of the “lofty” objectives he set for his administration and nation. His hope to make Rwanda a self-sufficient economy is encompassed in his Vision 2020, a series of goals that range from decreasing the number of citizens who live in poverty to developing the Rwandan stock market. During Kagame’s tenure, he has placed a heightened importance on education–making 12 years of schooling compulsory– while stimulating agriculture. His initiatives favoring universal health care, unification and reconciliation, and grassroots change have improved the quality of life and encouraged investment by outsiders. Although the authors seem too quick to dismiss criticism by Human Rights Watch and others, this is a fascinating portrait of a nation and a president at a pivotal moment in history. Agent: Delia Berrigan Fakis, DSM Literary Agency. (Nov.)

In their latest, Crisafulli and Redmond (coauthors of Comebacks: Powerful Lessons from Leaders Who Endured Setbacks and Recaptured Success on Their Terms) investigate the Rwandan renaissance, focusing on “Rwanda’s CEO,” Paul Kagame, a former refugee turned politician. Now in his second term as president, Kagame looks toward the future in light of the “lofty” objectives he set for his administration and nation. His hope to make Rwanda a self-sufficient economy is encompassed in his Vision 2020, a series of goals that range from decreasing the number of citizens who live in poverty to developing the Rwandan stock market. During Kagame’s tenure, he has placed a heightened importance on education–making 12 years of schooling compulsory– while stimulating agriculture. His initiatives favoring universal health care, unification and reconciliation, and grassroots change have improved the quality of life and encouraged investment by outsiders. Although the authors seem too quick to dismiss criticism by Human Rights Watch and others, this is a fascinating portrait of a nation and a president at a pivotal moment in history. Agent: Delia Berrigan Fakis, DSM Literary Agency. (Nov.)

Reviewed on: 08/27/2012

]]>

DSM Agency authors Patricia Crisafulli and Andrea Redmond have written an article on a well-regarded Wall Street program that was recently brought to Rwanda. You can read the entire article here.

RWANDA, INC. by Crisafulli and Redmond will be published in the fall by Palgrave-Macmillian.

As seen on Las Vegas Review-Journal:

February 19, 2012

John P. Strelecky, DSM Agency author of THE WHY CAFE, explains that employers look for “someone who approaches them with an idea of a new position, as long as it makes sense.”

Read the full article here.

]]>