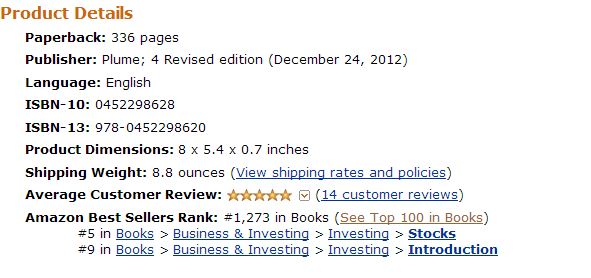

Stock Market Investing Rising on Amazon

The Neatest Little Guide to Stock Market Investing 2013 is now a top 10 book in Stocks and Introduction to Investing on Amazon!

Be sure to check a review of the book, as seen on The Dallas Public Library:

by Teresa Bocanegra

This really is the Neatest Little Guide to Stock Market Investing; it delves into just about everything you will need unless you have very advanced knowledge on the topic. First of all, there are the basics that many authors never discuss like what exactly are stocks and why and how does a company put stock up for sale on a major stock exchange? Author Jason Kelly includes a very interesting history lesson when answering these questions. From there he immediately jumps into the differences between the many types of brokers available to choose from (towards the end he then reviews specific brokers such as Fidelity, Schwab, TD Ameritrade and many others). Do you need a hands-on broker or perhaps an online account where you take charge of when and what to purchase with your funds? So that you are not left to float on your own, Kelly delves into stock analysis and such topics as “growth investing vs. value investing,” as well as “fundamental analysis vs technical analysis.” Next, how do you actually read and understand a detailed stock quote? What is “net profit margin,” or “price/book ratio” or “return on equity”? To let this all sink in, I recommend you pull up a stock quote and follow along as you read the book. For extended stock quotes, the Dallas Public Library has an online subscription to Morningstar and it is free to use with your library card number and pin. From the homepage, http://www.dallaslibrary2.org/ click the “Databases” link, and then “Business and Professional Resources,” from there, you will see Morningstar listed.

In the next section, Kelley introduces us to the “Masters” of investing. Profiled are Benjamin Graham, Philip Fisher, Warren Buffet, Peter Lynch, William O’Neil and Bill Miller. I was so inspired reading their stories and methods that I plan to find a couple of extended biographies on a couple of these legends. Their methods are then applied to numerous investing examples to help readers understand how to utilize these tools with their own investment choices. Kelly does not leave you to your own resources for further education, he takes the time to review multiple sources of information such as various magazines, newspapers, newsletters, and investment related websites. There is an extended coverage of Value Line Investment Survey and how to use it. “Value Line” is also available for free at the library. You will find this at the Central Library, 5th floor and at the Audelia Road Branch.

Kelly also discusses many of the free online tools available for analyzing stock. This book has a little bit of everything and points you in all the right directions for continuing your education. One of the last pieces of your education involves pulling together all the learning picked up throughout the book. You build your own portfolio, step by step and apply all the research methods and analysis that you’ve just read about. It is almost like a final exam (with open book and multiple resources) where all your learning gets put to the test. I highly recommend this book! I will use this again and again for a refresher and as a reference source.